I. Core Concepts of Exchange Rates and FX Trading

A. Understanding Exchange Rate Representation

- Fractional Representation of Exchange Rates:

- Explain how exchange rates are expressed as a fraction (e.g., ₩1100 / $1).

- Differentiate between the Fixed Currency (FC) and Variable Currency (VC) in this representation.

- Self-assessment: Can you identify the FC and VC in a given exchange rate?

- Interpreting Exchange Rate Movements:

- Define what “Dollar strength, Won weakness” (달러 강세, 원화 약세) signifies in the context of the Won/Dollar exchange rate.

- Relate exchange rate increases/decreases to the strength/weakness of the FC (Dollar).

- Self-assessment: If the exchange rate moves from ₩1100/$1 to ₩1050/$1, what does this imply about the Dollar and Won?

B. Spot vs. Forward Exchange Rates

- Spot Exchange Rate (현물 환율):

- Define the spot exchange rate and the T+2 rule (Trade Day + 2 days for settlement).

- Explain why transactions settling beyond T+2 are considered forward transactions.

- Self-assessment: What is the settlement period for a spot FX transaction?

- Forward Exchange Rate (선물 환율):

- Explain the need for forward exchange rates in future transactions.

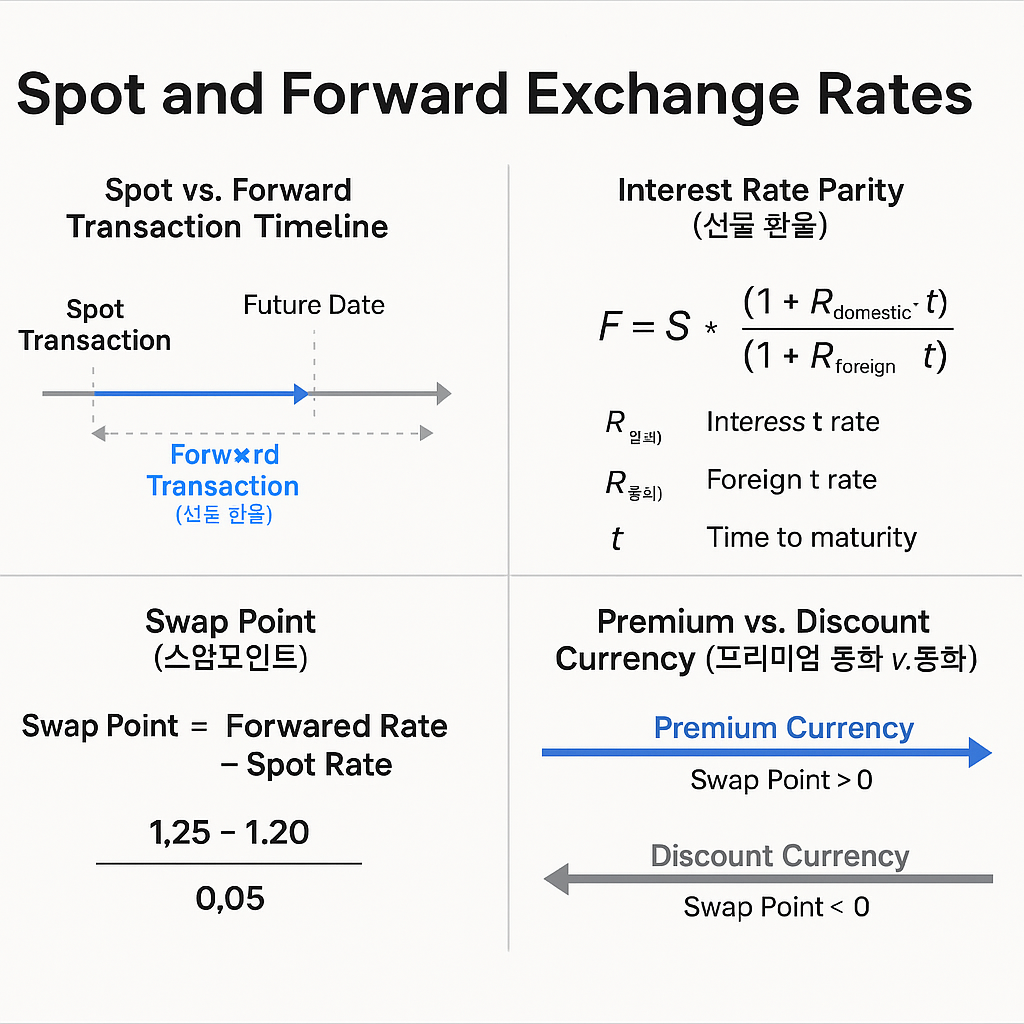

- Interest Rate Parity Principle:Describe how interest rates are incorporated into the forward exchange rate formula.

- Explain the role of R_dollar (R달러) and R_won (R원화) in the formula.

- Self-assessment: How does an increase in the dollar interest rate (R달러) affect the forward exchange rate?

- Swap Point (스왑포인트):

- Define swap point as the difference between the forward and spot exchange rates (Forward Rate – Spot Rate = Swap Point).

- Explain its significance as the difference in interest rates between two currencies, converted into an exchange rate.

- Discount vs. Premium Currencies:Define discount currency (디스카운트 통화) and premium currency (프리미엄 통화) based on the relationship between interest rates and swap points.

- Explain how swap points indicate whether a currency is at a premium (positive swap point) or discount (negative swap point).

- Self-assessment: If the swap point is negative, is the FC a premium or discount currency? What does this mean for selling the FC in a forward transaction?

II. FX Risk Hedging for Businesses and Banks

A. Corporate FX Hedging (환위험 헷지)

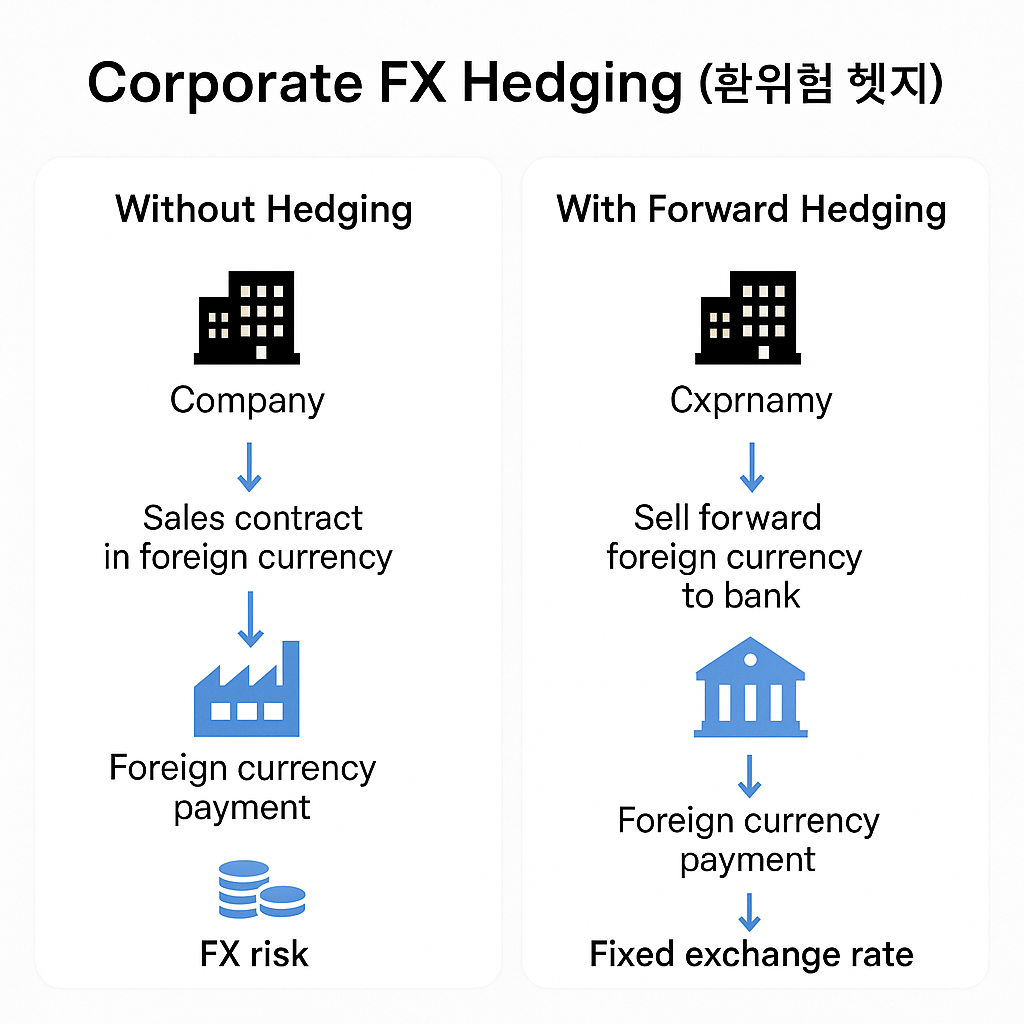

- Corporate Need for Hedging:Explain why exporting companies face FX risk (exchange rate fluctuations between contract and payment dates).

- Describe how companies typically hedge by selling forward foreign currency to banks.

- Self-assessment: What is the primary FX risk for an exporter expecting future dollar payments?

B. Bank Hedging of FX Risk

- Bank’s Initial Position:

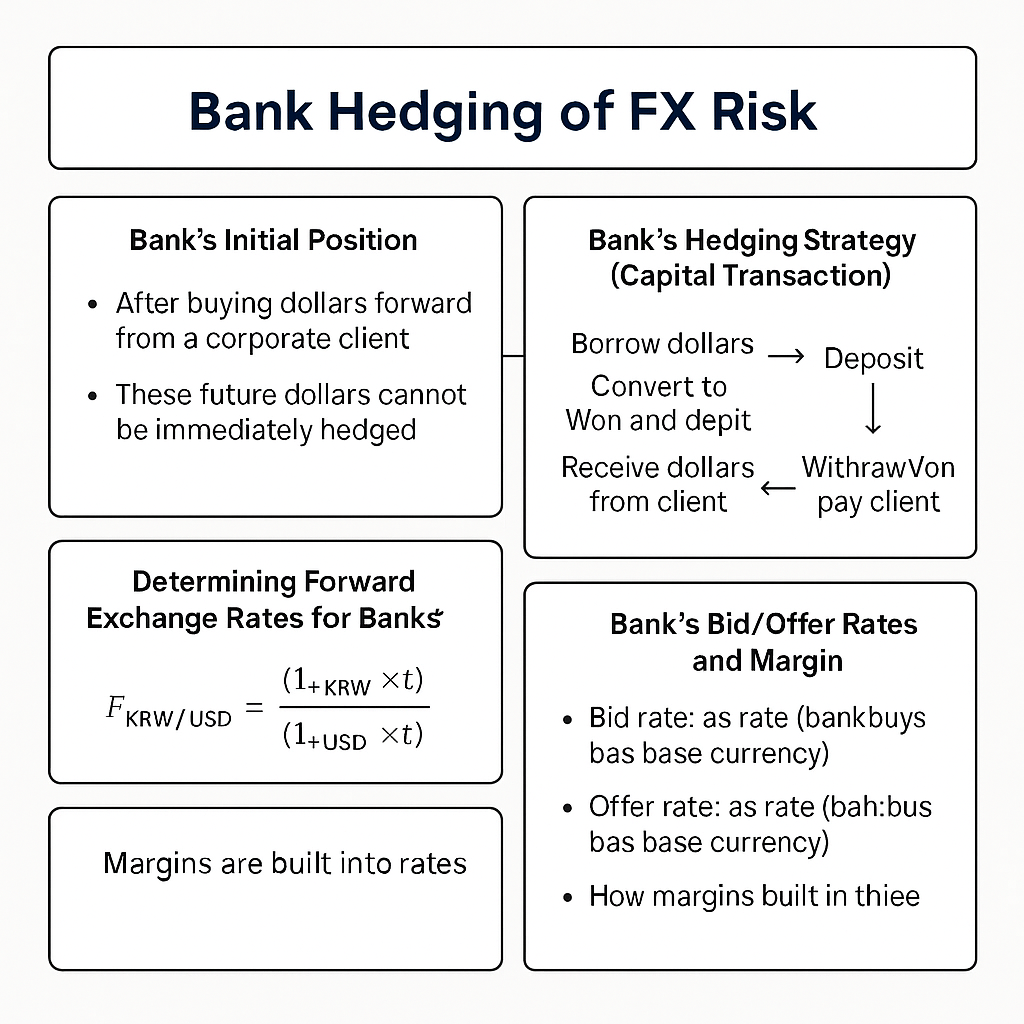

- Describe the bank’s long dollar position (달러롱 포지션) after buying dollars forward from a corporate client.

- Explain why banks cannot immediately convert these future dollars to hedge.

- Self-assessment: Why can’t a bank hedge a forward dollar purchase from a client by immediately converting the dollars to Won?

- Bank’s Hedging Strategy (Capital Transaction):

- Explain the bank’s strategy of borrowing dollars and lending Won to neutralise its FX risk.

- Detail the cash flows involved in this process (borrow dollars, convert to Won, deposit Won; then receive dollars from client, repay dollar loan; withdraw Won deposit, pay client).

- Self-assessment: Outline the key steps a bank takes to hedge a forward dollar purchase from an exporter using borrowing and lending.

- Determining Forward Exchange Rates for Banks:

- Explain which interest rates (borrowing/lending) are applied to which currencies in the forward rate calculation for banks.

- Bank’s Bid/Offer Rates and Margin:Define bid rate (비드 레이트) and offer rate (오퍼 레이트) in the context of bank quotes.

- Explain how the bank’s margin is embedded in these rates.

- Self-assessment: If a bank is buying dollars from a client, which rate (bid or offer) will it quote?

III. FX Swaps: A Comprehensive Solution

A. What is an FX Swap?

- Definition:

- Define an FX swap as a single contract involving a simultaneous spot and forward transaction in opposite directions.

- Explain how it simplifies the borrowing/lending process for banks.

- Self-assessment: How does an FX swap differ from separate spot and forward transactions?

- Types of FX Swaps:

- Buy & Sell Swap (바이앤 셀 스왑): Buying a currency spot and selling it forward.

- Sell & Buy Swap (셀앤바이 스왑): Selling a currency spot and buying it forward.

- Self-assessment: If a bank needs to acquire dollars spot and dispose of them forward, what type of swap would it execute?

- Pricing FX Swaps:

- Near Date : The spot leg of the swap, typically priced at the mid-rate between banks.

- Far Date : The forward leg, priced by adding swap points to the near date rate.

- Self-assessment: How is the Far Date rate determined in an FX swap?

B. Applications of FX Swaps

- Adjusting Forward Contract Maturity (선물환 만기 조정):

- Explain how buy & sell swaps can extend the maturity of a forward position.

- Explain how sell & buy swaps can shorten the maturity of a forward position.

- Demonstrate through examples how the hedging effect remains consistent despite maturity adjustments.

- Self-assessment: An exporter has a 3-month forward sale of dollars and wants to extend it to 6 months. How can an FX swap achieve this?

- Achieving Dollar Borrowing Effect (달러 차입 효과):

- Explain how combining Won borrowing with a buy & sell swap can effectively replicate dollar borrowing.

- Self-assessment: Describe how a company can simulate dollar borrowing using Won borrowing and an FX swap.

- Ante-Spot Transactions (안티스팟):

- Explain the concept of an anti-spot transaction (immediate settlement before T+2).

- Describe how a sell & buy swap (from the bank’s perspective) allows the bank to deliver currency immediately.

- Explain how swap points are applied in anti-spot transactions to reflect the time value of money when bringing settlement forward.

- Self-assessment: Why is an FX swap used in an anti-spot transaction? How does the swap point application differ from a standard forward transaction?

IV. Practical Considerations and Calculations

A. Interpreting Swap Point Quotes

- Sign Convention: Understand that negative swap points indicate a discount currency (often omitted in quotes, requiring careful interpretation).

- Bid/Offer Swap Points: Distinguish between bid and offer swap points and their application based on whether the bank is buying or selling the FC.

- Self-assessment: If a swap point quote is provided as 0.20/0.21 and the FC is a discount currency, what does 0.20 truly represent?

B. Applying Exchange Rate and Swap Point Calculations

- Forward Rate Calculation: Practice calculating forward rates using spot rates and swap points for various scenarios (e.g., bank buying forward, bank selling forward).

- FX Swap Calculations: Work through examples of FX swap pricing, especially for near and far dates.

- Anti-Spot Calculations: Understand how swap points are applied to determine the T0 rate for anti-spot transactions.

Quiz: Foreign Exchange Swaps and Risk Management

Instructions: Answer each question in 2-3 sentences.

- Explain the concept of Fixed Currency (FC) and Variable Currency (VC) in the context of an exchange rate expressed as a fraction.

- If the exchange rate for USD/KRW increases from ₩1100/$1 to ₩1200/$1, what does this indicate about the strength of the US Dollar and the Korean Won?

- What is the “T+2 rule” in foreign exchange spot transactions, and what does it mean for transactions settling beyond this period?

- Define “swap point” and explain what it primarily represents in terms of financial differences between two currencies.

- An exporting company expects to receive US dollars in three months. What is their primary foreign exchange risk, and how can they typically hedge against it using a bank?

- When a bank agrees to buy future dollars from an exporter, it creates a “dollar long position.” Why can’t the bank immediately hedge this position by converting dollars to Won?

- How does a bank typically resolve the issue of a future dollar long position to hedge its currency risk without waiting for the future payment?

- Briefly explain the main difference between a “Buy & Sell Swap” and a “Sell & Buy Swap” from the perspective of the currency being traded.

- Describe how an FX swap can be used to extend the maturity of an existing forward foreign exchange position.

- What is an “anti-spot” foreign exchange transaction, and how does an FX swap facilitate it?

Quiz Answer Key

- The Fixed Currency (FC) is the denominator in the exchange rate fraction, which is fixed at ‘1’ unit (e.g., 1 US Dollar). The Variable Currency (VC) is the numerator, representing the varying amount of the second currency needed to exchange for one unit of the FC (e.g., 1100 Korean Won).

- An increase in the USD/KRW exchange rate from ₩1100/$1 to ₩1200/$1 indicates that the US Dollar has strengthened (appreciated) relative to the Korean Won, meaning it now takes more Won to buy one Dollar. Conversely, the Won has weakened (depreciated).

- The T+2 rule states that foreign exchange spot transactions settle two business days after the trade date. Transactions that settle beyond this T+2 period, such as those settling immediately (T0, T+1) or at a future date (e.g., T+30), are considered forward transactions.

- A swap point is the difference between the forward exchange rate and the spot exchange rate (Forward Rate – Spot Rate). It primarily represents the interest rate differential between the two currencies involved in the exchange, converted into a currency rate.

- The exporter’s primary foreign exchange risk is that the US dollar might depreciate against the Korean Won by the time they receive payment, resulting in fewer Won. They can hedge this risk by selling their expected future dollars to a bank via a forward contract.

- The bank cannot immediately hedge its dollar long position because the dollars from the exporter are a future receivable. The bank does not physically possess these dollars at the time of the forward contract to convert them, hence it cannot perform a spot transaction for immediate hedging.

- To hedge a future dollar long position, a bank typically borrows dollars in the present, immediately converts them to Won (which it then lends), and then repays the dollar loan with the dollars received from the exporter in the future, effectively hedging its exposure.

- In a “Buy & Sell Swap,” one buys a currency in the spot market (near date) and simultaneously sells the same amount of that currency in the forward market (far date). Conversely, a “Sell & Buy Swap” involves selling a currency spot and simultaneously buying it back forward.

- An FX swap can extend the maturity of a forward position by executing a “Buy & Sell Swap.” For example, to extend a 1-month forward sale to 2 months, one performs a Buy & Sell swap for 1 month, which effectively cancels the existing 1-month forward position and creates a new 2-month forward position.

- An “anti-spot” transaction refers to a foreign exchange transaction that settles on the trade date (T0) or the next day (T+1), rather than the standard T+2 spot settlement. An FX swap facilitates this by allowing the bank to provide immediate funds by effectively bringing forward a future settlement through a “Sell & Buy” swap.

Essay Format Questions

- Discuss the fundamental differences between spot and forward exchange rate transactions, detailing how interest rate differentials influence the calculation of forward rates and the concept of swap points.

- Analyse how exporting companies utilise forward contracts to manage foreign exchange risk. Subsequently, explain the complex process banks undertake, including the “capital transaction” approach, to hedge the foreign exchange risk they assume from these corporate forward contracts.

- Elaborate on the definition and mechanics of a foreign exchange swap. Provide detailed examples of how different types of FX swaps (Buy & Sell, Sell & Buy) can be strategically employed to adjust the maturity of existing forward positions.

- Beyond adjusting forward contract maturities, describe two other practical applications of foreign exchange swaps as discussed in the source material. For each application, explain the underlying financial need and how the swap effectively addresses it.

- Critically evaluate the implications of a currency being classified as a “discount currency” or a “premium currency” based on swap points. How do these classifications affect the pricing of forward contracts and the perceived cost or benefit of holding that currency?

Glossary of Key Terms

- Anti-Spot (안티스팟): A foreign exchange transaction that settles earlier than the standard spot settlement (T+2), typically on the trade date (T0) or T+1.

- Bid Rate (비드 레이트): The price at which a bank is willing to buy a currency.

- Buy & Sell Swap (바이앤 셀 수업): An FX swap where a currency is bought in the spot market (near date) and simultaneously sold in the forward market (far date).

- Capital Transaction (자본 거래): The bank’s hedging strategy involving borrowing one currency and lending another to neutralise foreign exchange risk.

- Discount Currency (디스카운트 통화): A currency for which the forward exchange rate is lower than the spot exchange rate, typically because its interest rate is higher than the other currency in the pair. This results in negative swap points.

- Far Date (파 데이트): The future settlement date in an FX swap, where the opposite leg of the transaction occurs. The exchange rate for this date is derived from the near date rate plus or minus the swap points.

- Fixed Currency (FC): In an exchange rate expressed as a fraction, this is the currency fixed at ‘1’ unit in the denominator (e.g., 1 US Dollar in ₩1100/$1).

- Forward Exchange Rate (선물 환율): The exchange rate agreed upon today for the exchange of currencies on a specified future date. It reflects the spot rate adjusted for interest rate differentials.

- Foreign Exchange (FX) Swap (외환 스왑): A single transaction involving the simultaneous spot purchase/sale of a currency and a forward sale/purchase of the same amount of that currency. It combines a spot and a forward transaction in opposite directions.

- FX Hedging (환위험 해지): Strategies employed to mitigate the risk of adverse movements in exchange rates.

- Near Date (니어 데이트): The spot settlement date in an FX swap, where the first leg of the transaction occurs.

- Offer Rate (오퍼 레이트): The price at which a bank is willing to sell a currency.

- Premium Currency (프리미엄 통화): A currency for which the forward exchange rate is higher than the spot exchange rate, typically because its interest rate is lower than the other currency in the pair. This results in positive swap points.

- Sell & Buy Swap (셀앤바이 스왑): An FX swap where a currency is sold in the spot market (near date) and simultaneously bought back in the forward market (far date).

- Spot Exchange Rate (현물 환율): The current exchange rate at which currencies can be exchanged for immediate delivery (typically T+2).

- Swap Point (스왑 포인트): The difference between the forward exchange rate and the spot exchange rate (Forward Rate – Spot Rate). It reflects the interest rate differential between two currencies over the forward period.

- T+2 Rule: The standard convention in foreign exchange markets where settlement of a spot transaction occurs two business days after the trade date (T).

- Trade Day (트레이드 데이): The date on which a foreign exchange transaction is agreed upon.

- Variable Currency (VC): In an exchange rate expressed as a fraction, this is the currency whose amount varies in the numerator (e.g., ₩1100 in ₩1100/$1).

- Won Weakness (원화 약세): An increase in the exchange rate (e.g., USD/KRW) indicating that the Korean Won has depreciated relative to the US Dollar, meaning it takes more Won to buy one Dollar.