(Industry Analysis, 2025 Edition)

1. Executive Summary

The global AI ecosystem has entered an era defined not by algorithmic novelty but by control of compute — the chips, data centers, and power that fuel intelligence at scale.

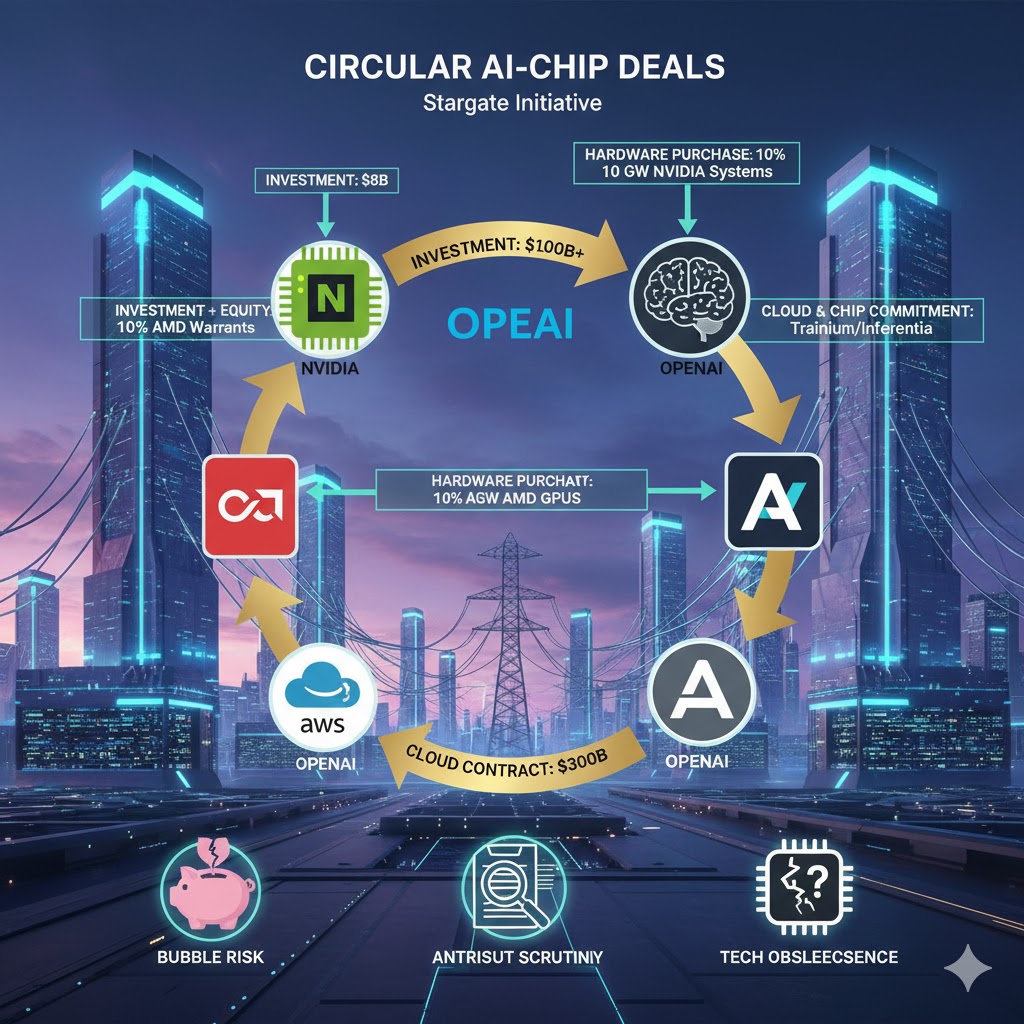

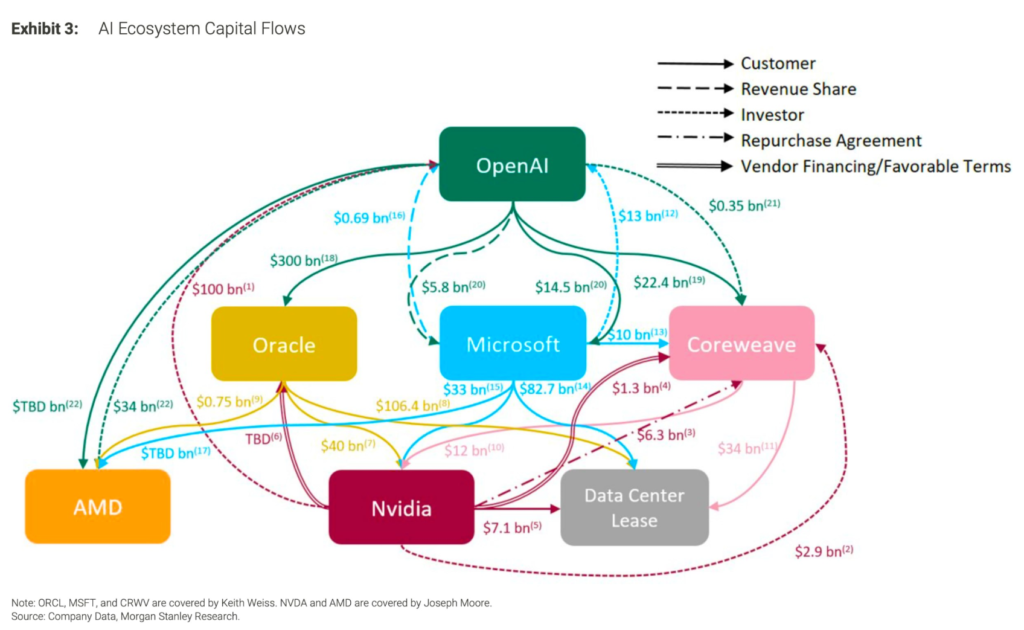

Between 2023 and 2025, a web of symbiotic “circular megadeals” emerged among model developers, chipmakers, and cloud providers — collectively exceeding $1 trillion in commitments.

These transactions intertwine equity investment, supply contracts, and infrastructure financing into self-reinforcing loops:

Chipmaker → Capital → AI Developer → Hardware Purchases → Chipmaker Revenue.

While these arrangements have accelerated the build-out of the world’s AI infrastructure, they also carry profound financial, competitive, and systemic risks — from valuation inflation and regulatory exposure to potential overcapacity and capital misallocation.

This report deconstructs the anatomy, motivations, and consequences of these circular alliances, providing an integrated view of the AI–chip industrial complex as it evolves into a global economic pillar.

2. Market Context: The Compute–Capital Nexus

2.1 The New Bottleneck

Compute, once a cost line, has become the strategic choke point of AI.

By 2030, global AI market value is projected to reach $826 B, expanding at a 35.7% CAGR, driven by exponential model size and multimodal workloads.

Training a single next-generation frontier model can require 10–20 GW of compute — more than the annual consumption of a small nation.

2.2 Capital Expenditure Supercycle

Hyperscalers (Meta, Microsoft, Alphabet, Amazon) are expected to deploy $325 B in capex in 2025 alone, mostly for AI data centers.

That figure rivals the GDP of Portugal and represents the largest synchronized infrastructure expansion in tech history.

(Chart placeholder: Global AI Infrastructure Capex 2020–2025E, USD B)

2.3 Strategic Realignment

The AI stack is consolidating into a few vertically integrated ecosystems:

| Layer | Dominant Players | Strategic Focus |

|---|---|---|

| Model Development | OpenAI, Anthropic, Google DeepMind, Meta | Foundation model scaling, multimodality |

| Semiconductor Supply | NVIDIA, AMD, TSMC, Intel | GPU/accelerator design and fabrication |

| Cloud & Infrastructure | Microsoft Azure, AWS, Google Cloud, Oracle Cloud | Compute provisioning, power, networking |

| Financing & Ownership | SoftBank, MGX, sovereign funds | Capital pooling, national compute initiatives |

The resulting structure resembles a semi-closed industrial cartel anchored around compute control.

3. The Circular Megadeals: Transaction Anatomy

(Table 1 — Major AI–Chip Circular Deals, 2023–2025)

| Year | Parties | Deal Type | Value / Capacity | Structure | Strategic Intent |

|---|---|---|---|---|---|

| 2023 | Amazon (AWS) ↔ Anthropic | Convertible equity + cloud supply | Up to $4 B | AWS invests; Anthropic commits to Trainium/Inferentia | Secure AI workloads for AWS |

| 2024 | Amazon (AWS) ↔ Anthropic | Follow-on investment | + $4 B | Additional convertible notes | Reinforce exclusive chip use |

| 2023 | Microsoft ↔ d-Matrix | Venture equity | $110 M Series B | Minority stake; Azure deployment rights | Access new inference chips |

| 2023 | Google Cloud ↔ Anthropic | Tech partnership | N/A | TPU v5e accelerator integration | Lock Anthropic workloads to TPUs |

| 2025 | NVIDIA ↔ OpenAI | Strategic investment + supply | Up to $100 B; 10 GW | NVIDIA invests; OpenAI buys NVIDIA systems | Mutual lock-in, compute security |

| 2025 | AMD ↔ OpenAI | Supply + equity warrants | 6 GW GPU; 10% stake option | Warrants vest by performance | Hedge vs NVIDIA, align incentives |

| 2025 | Oracle ↔ OpenAI | Cloud contract | $300 B; 4.5 GW capacity | 5-year Stargate deal | Elevate OCI into AI top tier |

The following table breaks down the key partnerships, their staggering scale, the technology involved, and the strategic thinking behind them.

| Partnership | Announced Value / Scope | Primary Technology | Key Financial Structure | Strategic Rationale |

| OpenAI & NVIDIA | Up to $100B Investment; 10 GW Compute Capacity | NVIDIA “Vera Rubin” Platform | Circular Investment: NVIDIA invests in OpenAI, which then buys NVIDIA’s systems. | For OpenAI: Secure privileged access to top-tier chips. For NVIDIA: Lock in its most important customer long-term. |

| OpenAI & AMD | 6 GW Compute Capacity; Warrants for up to 10% of AMD | AMD Instinct MI450 Series | Equity-Based Incentive: OpenAI gets a stake in AMD, vesting on deployment milestones. | For OpenAI: Diversify chip supply and reduce NVIDIA dependence. For AMD: Gain ultimate validation from the top AI company. |

| Amazon & Anthropic | $8B Total Investment | AWS Trainium & Inferentia Chips | Direct Investment: Amazon invests for cloud and chip usage commitments. | For Amazon: Secure a premier AI partner and drive adoption of its in-house silicon. For Anthropic: Gain funding and infrastructure to compete with OpenAI. |

| OpenAI & Oracle | $300B Cloud Contract; 4.5 GW Capacity | Oracle Cloud Infrastructure (OCI) with NVIDIA GPUs | Long-Term Cloud Services Agreement | For OpenAI: Massively diversify cloud providers beyond Microsoft Azure. For Oracle: Catapult OCI into a top-tier AI infrastructure provider. |

4. Financial Architecture: Circular Capital Flows

Circular financing mimics vendor-financing structures from the dot-com and telecom eras, but at vastly larger scale.

4.1 Flow Diagram

(Text chart)

NVIDIA → Invests $100 B → OpenAI → Buys NVIDIA chips → Revenue returns to NVIDIA

AMD → Issues warrants → OpenAI → Purchases AMD GPUs → Stock value rises → AMD gains capitalization

The “loop” inflates both top-line sales and valuation multiples, as investment capital re-enters as reported revenue.

Goldman Sachs and Morgan Stanley have warned that up to 15–20% of projected GPU demand may be “circularly financed.”

4.2 Balance-Sheet Effects

| Entity | Capital Outflow | Capital Inflow | Revenue Recognition | Risk Exposure |

|---|---|---|---|---|

| NVIDIA | Investment → OpenAI | GPU sales revenues | Short-term revenue boost | Counterparty & regulatory |

| AMD | Warrants issued to OpenAI | Hardware sales | Deferred revenue via milestones | Dilution & concentration |

| OpenAI | Equity received | Hardware purchases | Infrastructure asset | Liquidity & profitability gap |

| Oracle | Capex build for Stargate | Cloud service revenue | Long-term recurring cashflows | Leverage & power cost risk |

Financial Flow Analysis: Unpacking the Circular Loop

This table details how capital and equity move between the partners in the two most prominent circular deals, highlighting the innovative and controversial nature of these arrangements.

| Partnership | Entity | Capital Outflow | Capital Inflow | Resulting Transaction & Flow | Equity Component |

| OpenAI & NVIDIA | NVIDIA | Intends to invest up to $100B in OpenAI. | Receives payment for chip orders. | Circular Revenue: NVIDIA’s investment returns as revenue from OpenAI’s purchases. | Acquires non-controlling shares in OpenAI. |

| OpenAI | Places orders for 10 GW of NVIDIA systems. | Receives up to $100B from NVIDIA. | |||

| OpenAI & AMD | AMD | Receives payment for chip orders. | Direct Revenue: OpenAI pays AMD for GPUs, generating “tens of billions” in revenue for AMD. | Issues warrants for up to 10% of the company to OpenAI. | |

| OpenAI | Commits to purchase 6 GW of AMD GPUs. | Receives warrants vesting on deployment and stock price milestones. |

Export to Sheets

5. Risk Landscape

(Table 2 — Circular Deal Risk Matrix)

| Risk Category | Description | Likelihood (1–5) | Impact (1–5) | Overall Risk Rating | Key Drivers / Comments |

|---|

| Circular Revenue Illusion & Valuation Risk | Artificial inflation of demand and revenue from internal capital loops (vendor financing). | 4 | 4 | High | Analysts (e.g., Goldman Sachs) warn NVIDIA’s and AMD’s AI growth could include circular demand. Market correction risk if real end-user demand underperforms. |

| Regulatory / Antitrust Scrutiny | Authorities may investigate anti-competitive cross-holdings and preferential access to compute or chips. | 3 | 5 | High | U.S. DOJ and FTC already monitoring NVIDIA–OpenAI & AMD–OpenAI; similar to telecom vendor financing concerns from 2000s. |

| Competitive Lock-In / Market Concentration | Chipmakers may favor AI firms they invest in, excluding rivals from access or competitive pricing. | 3 | 4 | High | Heightened concentration around NVIDIA, AMD, Microsoft, and Anthropic. Potential structural remedy risk. |

| Execution / Counterparty Failure | Partner AI firm fails to scale or defaults, impairing chipmaker’s investment and hardware orders. | 3 | 3 | Medium–High | Venture-style funding models create correlated exposure; failure of one firm (e.g., AI startup) could ripple through GPU demand. |

| Technological Obsolescence | Long-term lock-in to one chip architecture limits ability to pivot as new technology arises. | 2 | 4 | Medium | Particularly relevant for AI firms with single-vendor commitments (e.g., TPU vs. GPU vs. custom ASIC). |

| Disclosure & Transparency Risk | Related-party transactions obscure true profitability, margins, and demand. | 3 | 3 | Medium | Many deals structured as convertible notes / internal offsets. Regulators may demand segment-level clarity. |

| Macroeconomic / Capital Market Risk | Circular structures depend on continuous funding and high equity valuations. | 3 | 4 | Medium–High | Any AI spending slowdown or interest rate hike can break the loop, leading to cash flow mismatches. |

| Systemic / Concentration Risk | Overconcentration in a few players creates correlated tail risk. | 2 | 3 | Medium | “Too-interconnected-to-fail” dynamic emerging in AI infrastructure ecosystems. |

| Geopolitical / Policy Risk | Cross-border chip investment deals vulnerable to export controls and national security reviews. | 2 | 4 | Medium | Especially relevant to TSMC, AMD, NVIDIA, and sovereign fund investors. |

5.1 Amplification Channels

- Feedback loops: Decline in AI demand → reduced chip orders → valuation shock.

- Liquidity mismatch: Equity stakes illiquid vs immediate cash obligations.

- Moral hazard: Chipmakers may overlook AI clients’ fundamentals due to equity exposure.

5.2 Quantitative Signals

- OpenAI: Operating loss $7.8 B on $4.3 B revenue (1H 2025).

- AMD: Market cap + $80 B in one day post-deal.

- Oracle: + $250 B market value jump on OpenAI contract.

These valuation surges exceed fundamental contribution, suggesting exuberant expectations.

6. Geopolitical and Regulatory Dimensions

6.1 The “Silicon Curtain”

Export controls bifurcate the chip market: U.S. vs China.

NVIDIA’s “China-compliant” GPUs (H20, L20) illustrate revenue fragmentation.

Any Taiwan instability (TSMC > 50% global foundry capacity) remains a systemic chokepoint.

6.2 Regulatory Posture

- United States: DOJ & FTC (2024 memorandum) monitor AI cross-ownerships.

- European Union: Digital Markets Act applies to cloud-AI verticals.

- Asia: Korea and Japan advancing AI Resilience Acts focusing on compute monopolies.

(Chart placeholder: Global regulatory initiatives vs market concentration)

6.3 Energy & Environmental Externalities

Stargate’s Abilene data center requires > 4 GW — necessitating dedicated natural-gas generation.

Projected emissions > 5 Mt CO₂ / year.

Compute is becoming a climate variable.

7. Scenario Forecasts (2026–2030)

(Table 3 — AI Infrastructure Scenarios)

| Scenario | Macro Context | Industry Outcome | Risk Profile |

|---|---|---|---|

| Baseline (“Managed Expansion”) | Moderate growth + regulatory stability | Gradual ROI realization; NVIDIA retains lead; AMD gains share via open ecosystem | Medium |

| Optimistic (“AI Utility Boom”) | Explosive adoption of AI services | Compute demand > supply; trillion-dollar capex sustained; valuation bubble extends | High |

| Correction (“Compute Glut”) | Monetization lags; capital tightens | Overcapacity of data centers; GPU price collapse; write-downs of investments | Severe |

| Fragmented Geopolitics | Trade controls tighten | Regional AI ecosystems; inefficient capacity duplication | High |

| Sustainability Mandate | Carbon constraints imposed | Shift to energy-efficient chips and localized compute | Medium-positive |

(Chart placeholder: Scenario probability bands)

8. Strategic Implications

8.1 For Industry Leaders

- Diversify Compute Sources: Adopt multi-chip, multi-cloud models.

- Financial Discipline: Separate “strategic investments” from “revenue-driven supply.”

- Governance Firewalls: Keep investment and procurement decisions independent.

8.2 For Investors

- Focus on external, verifiable demand rather than inter-party revenues.

- Monitor capex-to-cash-flow ratios; > 2.5× indicates leverage strain.

- Expect consolidation waves; smaller startups may become acquisition targets.

8.3 For Policymakers

- Treat compute capacity as critical infrastructure; consider public-private financing frameworks.

- Enforce related-party disclosure rules similar to banking standards.

- Support open-source hardware stacks (ROCm, RISC-V) to dilute concentration.

9. Outlook: Beyond the Loop

The next decade’s question is whether these alliances mature into a stable industrial backbone or implode under their own feedback loops.

The probable path: continued expansion through 2027, followed by valuation normalization as ROI metrics replace narrative growth.

If compute remains the “new oil,” then the firms mastering both refining (chips) and distribution (cloud) will dictate the next era of technological power.

But every boom anchored in circular capital has its gravity.

History’s warning: bubbles burst when capital stops believing in its own reflection.