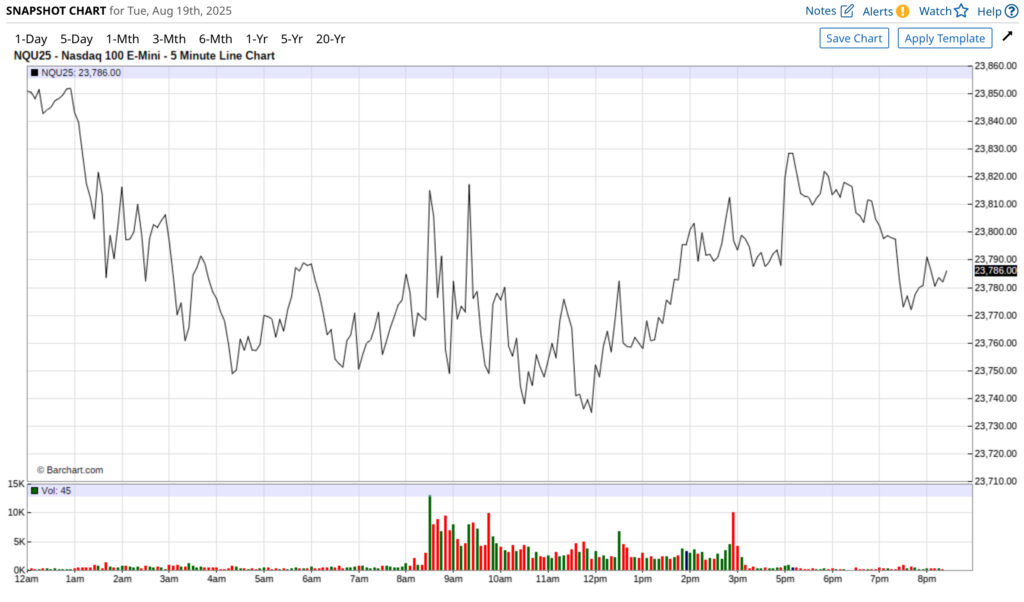

Report Date: 2025-08-18High and Low Price

On August 18, 2025, the Mini NASDAQ 100 futures experienced a high of 23,881.50 and a low of 23,721.25. The session opened at 23,851.00 and closed at 23,788.25, reflecting a slight downturn by the end of the day.

Mini NASDAQ 100 Futures Prices (2025-08-18)

| Metric | Price |

|---|---|

| High | 23,881.50 |

| Low | 23,721.25 |

| Open | 23,851.00 |

| Close | 23,788.25 |

Explanation of Price Movements

Mini NASDAQ 100 futures (NQU25) exhibited a slight pullback on August 18, 2025, with the index ($IUXX) and futures both down around 0.09% to 0.12%. This marked the third consecutive “red candle” for the futures after reaching a recent high, indicating a period of market consolidation or “catching its breath” after a significant rally.

Several factors contributed to this cautious sentiment:

- Weak Consumer Sentiment: A weaker-than-expected preliminary August US consumer sentiment index, which fell to 58.6 (below expectations), exerted downward pressure on stocks. Rising consumer expectations for inflation (4.9% over next year) and plans by 58% of consumers to cut spending due to inflation highlighted underlying economic concerns.

- Federal Reserve Policy Expectations: The Producer Price Index (PPI) report tempered market optimism regarding aggressive Federal Reserve rate cuts, leading to a slight pullback in expectations. While the CME FedWatch tool still indicated a high probability (92.6%) for a 25-basis point cut in September, the cooling of expectations for multiple cuts into 2026 weighed on sentiment.

- Rising Treasury Yields: Higher U.S. 10-year Treasury yields, which increased to 4.34% on August 18, acted as a drag on equity markets. Higher bond yields make fixed-income investments more attractive, diverting capital from riskier assets like tech stocks.

- Geopolitical Concerns: Ongoing discussions surrounding the Russia-Ukraine war, including a Trump-Putin summit, introduced geopolitical uncertainty and potential macroeconomic implications for tariffs and oil prices, contributing to mixed stock performance.

- Mixed Economic Data: While July U.S. retail sales were strong, supporting the economic growth outlook, the increase in July import prices and the Empire manufacturing index (11.9, stronger than expected) presented a mixed picture, with some data points suggesting persistent inflationary pressures.

Despite these headwinds, the market is generally seen as undergoing a “breather” rather than a major reversal, following strong Q2 S&P 500 earnings growth (9.1% year-over-year).

Future Outlook

The underlying bullish trend for Mini NASDAQ 100 futures is largely considered intact, despite the current cautious analyst sentiment and potential for short-term pullbacks. The market is seen as far from bearish, having recently formed a new all-time high. Any corrections are likely to be viewed as buying opportunities by aggressive buyers.

Key factors that will influence future movements include:

- Federal Reserve Commentary: Traders will closely monitor Fed Chair Jerome Powell’s remarks at the upcoming Jackson Hole symposium (August 21-23) for further cues on monetary policy.

- Economic Data Releases: Future economic data, particularly inflation figures (CPI, PPI), labor market reports, and consumer confidence surveys, will continue to shape expectations for Fed actions and overall economic health.

- Corporate Earnings: Upcoming earnings reports from major retailers will provide further insights into consumer demand and corporate profitability, which could influence market sentiment.

- Tariff Impacts: The increasing impact of tariffs on corporate earnings, profit margins, and inflation levels remains a key watch item, with the bulk of tariff impacts expected in Q4 2025 and early 2026.

While historical trends suggest August can be a weaker month with higher volatility, August 2025 has somewhat defied this, indicating underlying resilience. Strong support levels for the Nasdaq 100 E-mini futures are identified around 23,421.75 and the 50-day moving average at 22,959, which is seen as indicative of an intact underlying trend.

Latest Economic Data (August 2025)

| Economic Indicator | Latest Data/Forecast (August 2025) |

|---|---|

| Treasury Bond Rates | |

| 10-Year Treasury Note | 4.34% (as of Aug 18, 2025) |

| 2-Year Treasury Note | 3.75% (as of Aug 18, 2025) |

| 30-Year Treasury Note | 4.92% (as of Aug 15, 2025) |

| Effective Federal Funds Rate | 4.33% (from Aug 11-15, 2025) |

| GDP Growth | |

| Q2 2025 Real GDP Growth | 3.0% (annual rate) |

| Q3 2025 GDPNow Estimate | 2.5% (as of Aug 15, 2025) |

| 2025 Annual GDP Forecasts | EY: 1.5%; Deloitte: 1.4%; Vanguard: ~1.5%; Atlantic Council: 1.5%-2.7% |

Explanation of Economic Factors Influence on Price Movements

- Treasury Bond Rates:Rising Treasury bond yields, particularly the 10-year yield (4.34% on August 18), have a direct impact on Mini NASDAQ 100 futures. Higher yields make fixed-income investments more appealing compared to growth-oriented technology stocks that dominate the Nasdaq 100. This is because higher discount rates are applied to the future earnings of these companies, making their valuations less attractive. The observed increase in long-end yields was cited as a drag on equity markets. The U-shaped yield curve, suggesting current Federal Reserve rates are too high, alongside elevated long rates due to fiscal deficits and long-term inflation, implies persistent pressure that can raise borrowing costs for businesses and potentially slow economic expansion, particularly affecting companies sensitive to capital costs.

- Gross Domestic Product (GDP) Growth:While Q2 2025 saw a respectable 3.0% real GDP growth, the overall first half of 2025 was described as “mediocre.” Forecasts for 2025 indicate a deceleration in GDP growth (e.g., EY anticipates 1.5%). Strong GDP growth typically signals a robust economy, boosting corporate earnings and investor confidence, which generally supports equity indices. However, the decelerating growth outlook, combined with doubts about the underlying economy’s health (partly due to tariff pressures), suggests potential headwinds for future earnings and investor sentiment. The Atlanta Fed’s 2.5% Q3 forecast points to continued, albeit moderate, economic expansion, which offers a degree of underlying support to the market, preventing a more significant downturn.

- Inflation and Monetary Policy Expectations:Rising consumer inflation expectations (e.g., 4.9% for the next year) and persistent inflationary pressures indicated by the Producer Price Index (PPI) influence Federal Reserve policy expectations. If inflation remains elevated, the Fed might be compelled to maintain higher interest rates or slow the pace of cuts, which creates a less accommodative monetary environment. Higher interest rates increase the cost of borrowing for companies and consumers, potentially dampening economic activity and reducing corporate profits. For the tech-heavy Nasdaq 100, a tighter monetary policy environment can be particularly challenging as it impacts valuations based on future growth prospects. The market’s adjustment to potentially fewer Fed rate cuts into 2026 directly reflects this sensitivity.

- Tariffs:The continued impact of tariffs is a significant concern. Forecasts suggest tariffs will weigh on real GDP growth in late 2025 and 2026, contribute to higher inflation, and squeeze corporate earnings and profit margins. This creates uncertainty for businesses, affecting investment decisions and potentially leading to higher consumer prices. The anticipation of these impacts generally creates a cautious environment for equity markets, especially for companies with global supply chains