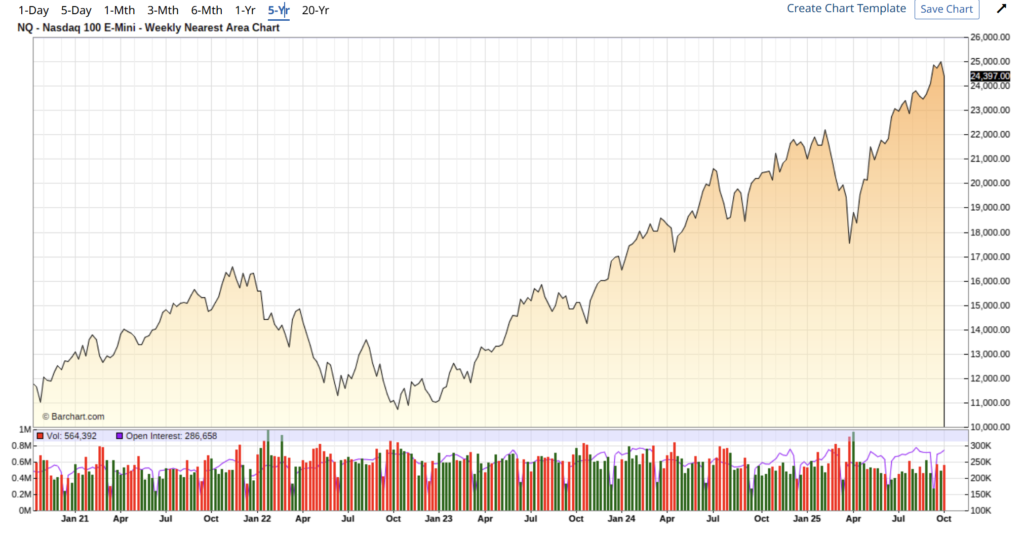

Report Date: October 10, 2025

Mini NASDAQ 100 Futures Prices for October 10, 2025

| Price Type | Price (USD) |

|---|---|

| High | 25,388.00 |

| Low | 24,158.50 |

| Open | 25,287.75 |

| Close | 24,397.00 |

Explanation of Price Movements

On October 10, 2025, Mini NASDAQ 100 futures experienced significant volatility, ultimately closing lower. The day commenced with an initial cautious sentiment driven by the ongoing U.S. government shutdown and the anticipation of the upcoming earnings season. Despite some early support from lower bond yields, which briefly propelled the Nasdaq 100 to a new all-time high of 25,192, market sentiment sharply deteriorated. The primary factor contributing to the decline was the escalation of U.S. trade tensions with China. President Trump’s threats of a “massive increase” of tariffs on Chinese goods, coupled with China’s reported “hostile” export controls on rare-earth minerals, triggered a broad sell-off in U.S. equity futures. This surge in geopolitical uncertainty overshadowed any earlier positive market drivers, resulting in a substantial daily decline for the Mini NASDAQ 100 futures.

Future Outlook for Mini NASDAQ 100 Futures

The outlook for Mini NASDAQ 100 futures remains predominantly bullish for the remainder of 2025 and into the longer term, primarily underpinned by the robust technology sector and the pervasive influence of Artificial Intelligence (AI). Global IT spending is projected for significant growth, with a 9.7% increase in 2025, and both data center and software segments are expected to achieve double-digit expansion, largely propelled by the increasing adoption of AI. Expectations of two additional Federal Reserve interest rate cuts in 2025, including a highly probable 25 basis point reduction in October to support the labor market, are anticipated to provide a tailwind for equities by lowering borrowing costs and enhancing equity valuations.

Despite this optimism, several moderating factors and risks persist. Persistent inflation, which remains above the Federal Reserve’s 2% target, could complicate the central bank’s easing path and introduce market uncertainty. Growing discussions about an “AI bubble” due to large “circular deals” among tech and chip-making companies raise valuation concerns. Geopolitical tensions, particularly regarding US-China trade relations and potential tariffs, pose a significant risk, as demonstrated by the market’s reaction on October 10. While the NASDAQ 100 has shown resilience, some consolidation may be expected before significant further gains, with resistance levels at 25,500 and 26,000. Longer-term projections, however, remain highly optimistic, with some forecasts suggesting the index could reach 34,000 points within five years.

Latest Economic Data

| Indicator | Value (as of Oct 10, 2025, or nearest) |

|---|---|

| 10-Year Treasury Yield | 4.14% (Oct 10, 2025) |

| 2-Year Treasury Yield | 3.58% (Oct 3, 2025) |

| 30-Year Treasury Yield | 4.71% (Oct 3, 2025) |

| Q2 2025 Real GDP Growth (Annualized) | 3.8% (Third Estimate, Sept 25, 2025) |

| Q3 2025 GDPNow Estimate | 3.8% (Oct 7, 2025) |

| Nominal GDP (June 2025) | $30.49 trillion |

Explanation of Economic Factors’ Influence on Price Movements

Treasury Bond Rates:

On October 10, 2025, the 10-year U.S. Treasury yield climbed to 4.14%. Generally, rising Treasury yields exert downward pressure on equity markets, especially for growth-oriented technology stocks that constitute a significant portion of the NASDAQ 100. This occurs because higher bond yields make fixed-income investments more attractive relative to riskier equities and increase borrowing costs for companies, potentially hindering investment and growth. While the market initially saw support from a dip in bond yields, the overall upward movement in the 10-year yield on October 10th contributed to the day’s subsequent sell-off. Looking ahead, expectations for future Federal Reserve rate cuts in 2025 suggest a potential easing of yields, which would typically be supportive of the NASDAQ by lowering the discount rate applied to future earnings and stimulating investment.

Gross Domestic Product (GDP):

TIn terms of GDP growth, the forecast for Q4 2025 indicates a notable slowdown in the US economy, with real GDP growth ranging from 1.0% to 2.3%. A decelerating economy typically implies weaker corporate earnings and reduced consumer spending, which could exert downward pressure on overall market performance. Factors contributing to this slowdown include persistent inflation (exacerbated by tariffs), weakening consumer spending, and a cooling labor market. Despite these broader economic headwinds, the research highlights that robust high-tech and AI-related investment serves as a significant “backstop” to 2025 GDP. This targeted investment in innovation is particularly beneficial for the technology sector, enabling the NASDAQ 100 to potentially show resilience or even outperform the broader market despite a more subdued general economic environment. The Federal Reserve’s delicate task of navigating slower growth alongside sticky inflation also introduces an element of uncertainty that can contribute to market volatility.