August 22, 2025

Prices for 2025-08-22

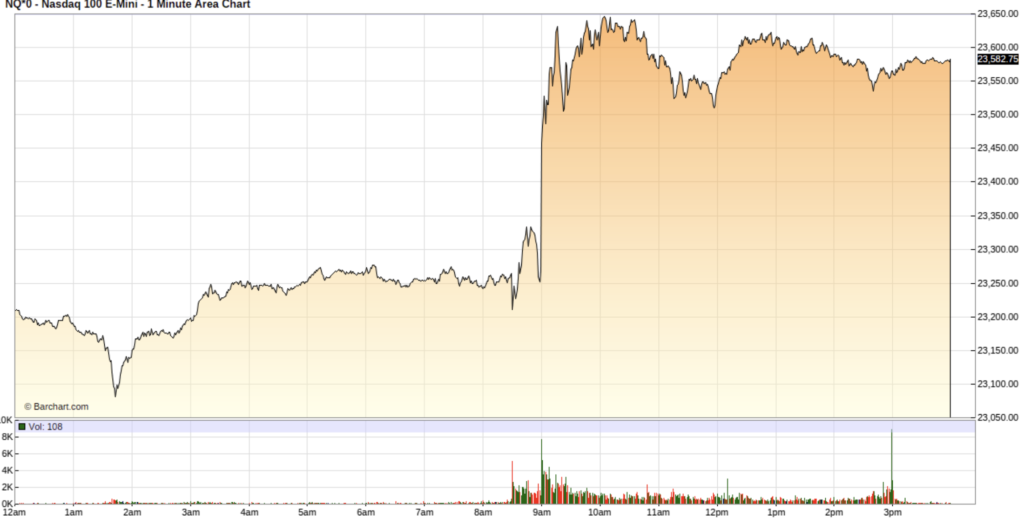

On August 22, 2025, the Mini NASDAQ 100 futures (NQU25) experienced a notable upward trend.

Detailed Price Metrics

| Metric | Price |

|---|---|

| High | 23,650.00 |

| Low | 23,076.75 |

| Open | 23,225.25 |

| Close | 23,569.75 |

Explanation of Price Movements

Mini NASDAQ 100 futures saw a significant rally on August 22, 2025, with the Nasdaq 100 E-mini Sep ’25 (NQU25) closing up by +1.51% at 23,569.75. This strong performance was primarily driven by dovish comments from Federal Reserve Chair Jerome Powell at the Jackson Hole symposium. Powell’s remarks, which highlighted downside risks to the labor market and acknowledged tariff-driven inflation pressures, were widely interpreted by markets as a strong signal for a potential interest rate cut in September. This expectation led to a “risk-on” sentiment among investors, resulting in a weakening of the U.S. Dollar and a drop in Treasury yields, both of which typically favor equity markets, especially growth-oriented technology stocks that comprise the Nasdaq 100. Traders rapidly priced in a nearly 90% probability of the Federal Open Market Committee (FOMC) implementing a rate reduction at its upcoming September policy meeting, fueling the surge in futures prices.

Future Outlook

The immediate future outlook for Mini NASDAQ 100 futures appears cautiously optimistic, predominantly influenced by the strong market expectation of a September interest rate cut by the Federal Reserve. This anticipated easing of monetary policy should provide a supportive environment for technology and growth stocks, potentially driving further upside. However, several underlying economic factors present a mixed picture. While the U.S. economy posted a robust 3.0% annualized GDP growth in Q2 2025, this followed a 0.5% contraction in Q1, and full-year 2025 real GDP growth is projected to decelerate to a range of 1.1% to 1.6%. The labor market is also showing signs of cooling, with the unemployment rate ticking up to 4.2% and job creation slowing.

Inflation remains a persistent concern, with core CPI accelerating to 3.1% and producer price inflation at 3.3%, largely exacerbated by rising tariffs, which are expected to approach an effective rate of 17% by year-end. While these inflation pressures could be a headwind, the Fed’s apparent focus on labor market risks suggests a greater willingness to accommodate higher inflation in the short term to support economic activity. From a technical perspective, forecasts for the NASDAQ 100 for early September 2025 project an average of 23302, with some more bullish analyses suggesting the index could reach 24,000 by the end of Q4 2025 and potentially exceed 25,000 points by year-end. The sustainability of this upward trend will depend heavily on the actual implementation of Fed rate cuts and whether broader economic indicators stabilize or deteriorate further. Any unexpected hawkish shifts from the Fed or significant economic downturns would pose considerable downside risks to this outlook.

Latest Economic Data

| Data Point | Value (as of 2025-08-22) |

|---|---|

| Treasury Bond Rates | |

| 2-year Treasury Note | 3.68% |

| 10-year Treasury Note | 4.26% |

| 20-year Treasury Bond | 4.84% |

| 30-year Treasury Note | 4.88% |

| 1-month Treasury Constant Maturity | 4.49% |

| 3-month Treasury Constant Maturity | 4.32% |

| 6-month Treasury Constant Maturity | 4.11% |

| 1-year Treasury Constant Maturity | 3.79% |

| GDP Data (United States) | |

| Q2 2025 Real GDP Growth (Advance) | 3.0% (annualized) |

| Q1 2025 Real GDP Growth | -0.5% (annualized) |

| Q3 2025 Real GDP Growth (GDPNow) | 2.3% (annualized, Aug 19) |

| Full-Year 2025 Real GDP Forecast | 1.1% – 1.6% |

Explanation of How Economic Factors Influence Price Movements

- Treasury Bond Rates: On August 22, 2025, Treasury yields, including the 2-year at 3.68% and the 10-year at 4.26%, declined significantly following Fed Chair Powell’s dovish remarks. Lower bond yields make fixed-income investments less attractive compared to equities. For growth stocks, which constitute a large portion of the Nasdaq 100, lower discount rates (implied by lower yields) increase the present value of future earnings, thereby boosting their valuations. This direct inverse relationship between bond yields and growth stock valuations was a primary catalyst for the strong performance of Mini NASDAQ 100 futures. The market’s anticipation of a further rate cut in September implies a continuation of this yield-supportive environment for equities.

- GDP Data: The U.S. GDP data presents a nuanced picture. The stronger-than-expected Q2 2025 real GDP growth of 3.0% (annualized) indicates underlying economic resilience, which is generally positive for corporate earnings and, consequently, equity markets. However, the preceding Q1 2025 contraction of -0.5% and the projected deceleration of full-year 2025 growth to 1.1%-1.6% suggest that the economy’s momentum might be slowing. The Atlanta Fed’s GDPNow model for Q3 2025, estimating 2.3% growth, also points to a moderation. This mixed but generally slowing growth outlook contributes to the Federal Reserve’s dovish stance. For the Mini NASDAQ 100, a slowing economy could be a headwind, but the expectation of Fed intervention (rate cuts) to prevent a deeper slowdown acts as a counterbalance, providing a floor for investor confidence and supporting future growth expectations. The notable decrease in imports in Q2, attributed to tariff pressures, also highlights how trade policy significantly impacts GDP components and, indirectly, the broader economic environment for companies.