Stagflation Analysis

An Interactive Economic Dashboard

Q3 2025

Economic Snapshot

This section provides a high-level overview of the key indicators defining the current stagflationary risk environment. These metrics form the basis of our deeper analysis.

Inflation (Core PCE, YoY)

3.5%

▲ Trending Above Target

Real GDP Growth (Annualized)

1.0%

▬ Stagnant / Below Trend

Unemployment Rate

4.3%

▲ Slowly Ticking Upward

Causal Analysis: Past and Present

Understanding the threat of stagflation requires looking at both historical precedents and current, unique economic pressures. This section allows you to explore the factors contributing to the current risk.

Historical Parallel: The 1970s vs. Today

Toggle between metrics to compare the trends of the 1970s stagflationary period with the current environment. This helps contextualize the severity of today’s situation.

Modern Risk Factors

Click on each factor to see a detailed explanation of its contribution to the risk of stagflation. This interactive diagram shows how different pressures combine.

Supply Chain Disruptions & Geopolitics

Aggressive Monetary Policy

Slowing Consumer Demand

Click a factor above for details.

Scenario Modeler

The path forward is not set. This modeler allows you to explore three potential economic scenarios for the next 12-18 months and see their projected impact on key asset classes.

Projected Asset Performance: Stable Growth

Scenario Analysis

Stable Growth (Soft Landing)

In this optimistic scenario, inflation gradually returns to the Fed’s 2% target without a significant economic downturn. Growth remains resilient, and unemployment stays low. U.S. equities perform well, driven by steady earnings, while bonds provide modest returns. Commodities see less upward pressure.

Policy Simulator

Stagflation presents a profound dilemma for policymakers. Use the sliders below to simulate different policy responses and observe the difficult trade-offs between controlling inflation and supporting growth.

Policy Levers

Projected Outcomes

Projected Inflation

3.5%

Projected GDP Growth

1.0%

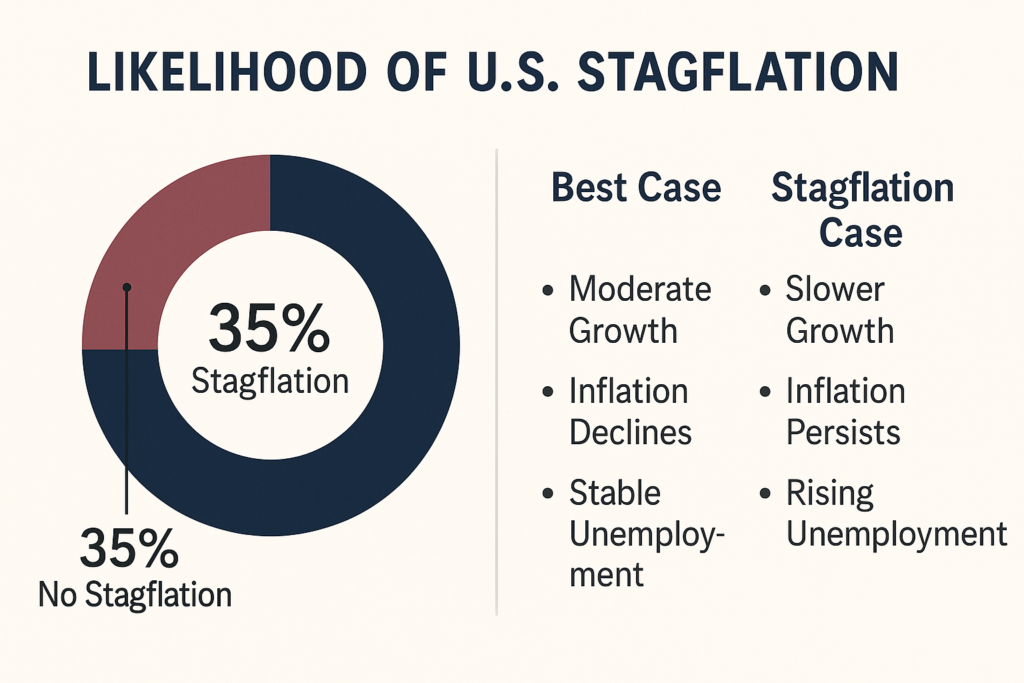

Stagflation Risk Calculator

Adjust the sliders for the three main economic indicators to calculate a theoretical stagflation likelihood score. This tool helps illustrate how changes in these metrics contribute to the overall risk.

Economic Inputs

Calculated Risk Likelihood

Moderate Risk

The combination of above-target inflation, slow growth, and rising unemployment points to a significant risk of stagflation.