나스닥 또는 코스닥 어디에 투자해야 하나 ?

Policy Rates & Market Reactions

An Interactive Report on the Comparative Impact of Central Bank Policy on NASDAQ and KOSDAQ (2005–2025)

Report Introduction

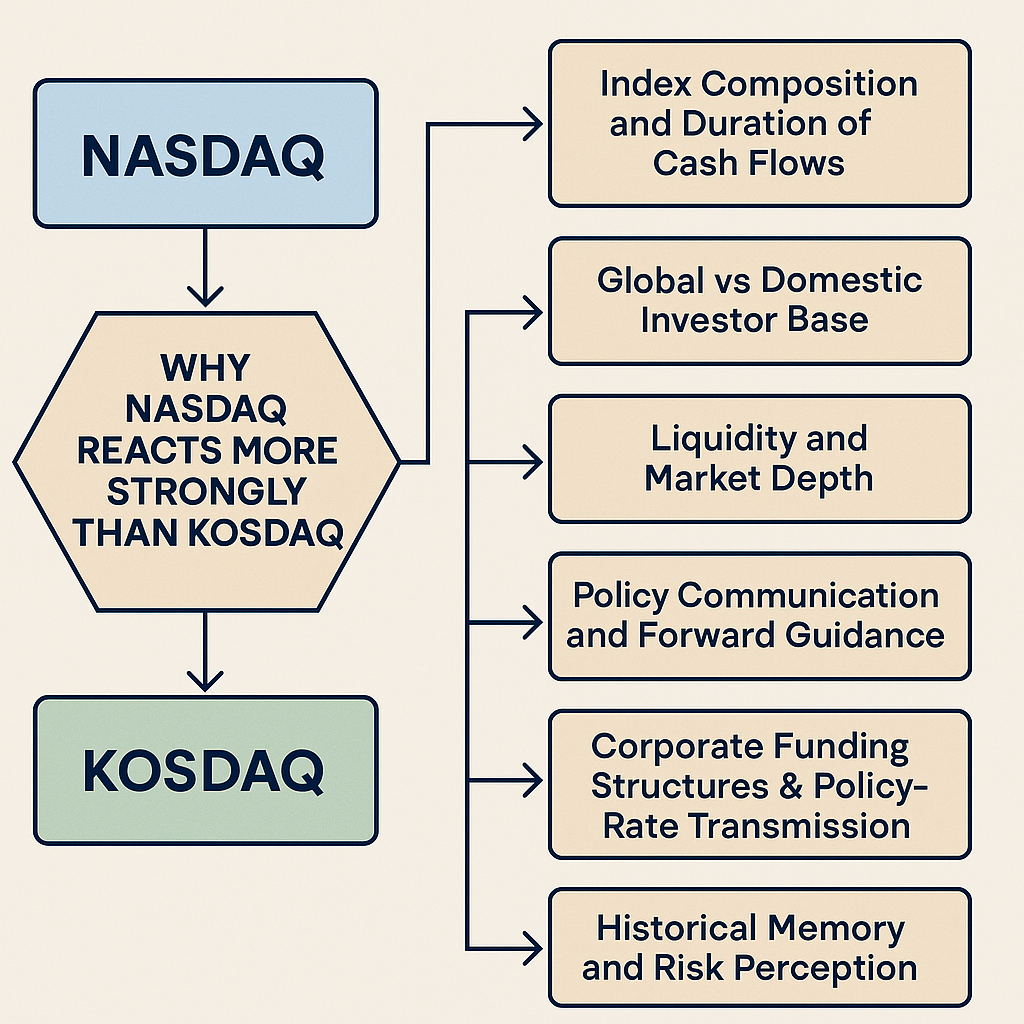

Over the past two decades, equity markets in the United States and South Korea have navigated dramatic shifts in monetary policy. This interactive report, based on a comprehensive analysis from 2005-2025, examines how the tech-heavy U.S. NASDAQ and Korean KOSDAQ indices have reacted to changes in their respective central bank policy rates, uncovering why the NASDAQ often responds more sharply to policy shifts.

10x

Approx. NASDAQ growth from its 2009 trough to its 2021 peak.

3x

Approx. KOSDAQ growth during the same period.

-33%

NASDAQ’s decline in 2022 during aggressive Fed tightening.

Quantitative Sensitivity to Interest Rates (2021-2023)

Regression analysis reveals NASDAQ’s much higher sensitivity. For every 1 basis point (0.01%) increase in the U.S. 10-Year Treasury yield, the NASDAQ showed a correspondingly larger negative return compared to the KOSDAQ.